What does the new e-invoicing legislation mean for your business?

From 1 January 2026, all Belgian companies are required to use (streamlined) e-invoicing for business transactions. This European directive aims to reduce administrative burdens and make business processes more efficient.

Specifically, this means:

- Invoices in UBL format: Structured invoices via a secure network (Peppol).

- No paper invoices, nor PDFs send: Everything must be digital and automatic.

- Less manual work, fewer errors and faster payments.

- Automation: Real-time status updates of invoices.

- European standards, enabling smooth international cooperation.

How do you fulfil this obligation?

You need an automated invoicing system that is compliant with Peppol. It therefore requires in many cases an investment in new software. For example, with Microsoft Dynamics 365 Business Central you can not only comply with regulations, but also modernise and optimise your administrative processes.

What is Peppol and why is it important?

Peppol (Pan-European Public Procurement OnLine) is an international network connecting businesses and governments for secure and standardised e-invoicing. It provides a uniform way to exchange electronic invoices.

Benefits of Peppol:

-

- Compliance: It complies with all European e-invoicing standards.

- Efficiency: No hassle with different formats or manual processing.

- Safety: Invoices are thus always sent over a secure network.

Microsoft Dynamics 365 Business Central offers seamless integration with Peppol, making it effortless to comply with e-invoicing requirements. As a result, you are immediately compliant.

Tax benefits for e-invoicing

Are you already working with Microsoft Dynamics 365 Business Central? Then the switch to e-invoicing via Peppol is quick. Moreover, there are tax advantages:

- 120% cost deduction: Valid for subscription fees and advice around e-invoicing.

- Valid for the self-employed, liberal professions and small companies.

- Period: From 1 January 2024 to 31 December 2027.

Additional benefits for Business Central users:

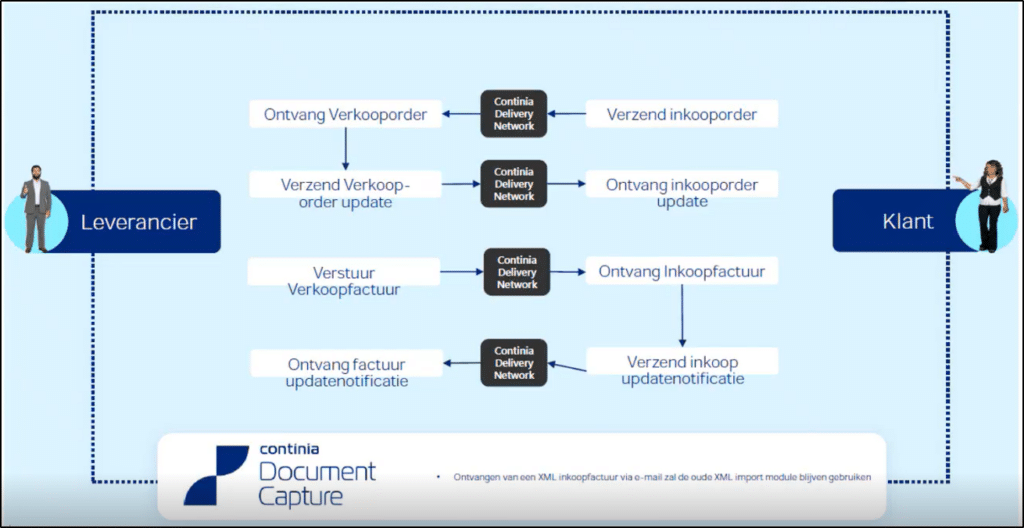

- Automatic processing of incoming and outgoing invoices thanks to integration with Continia Document Capture.

- Fewer administrative errors thanks to standardised processes.

- Full (real-time) insight into your financial flows via a central ERP solution.

Why switch now?

Are you still using an outdated ERP system such as Navision? Then now is the time to switch. With Business Central you not only get e-invoicing, but also powerful tools for digitising your financial, logistics and operational processes.

How can VanRoey help?

VanRoey guides your organisation step by step to a future-proof invoicing process.

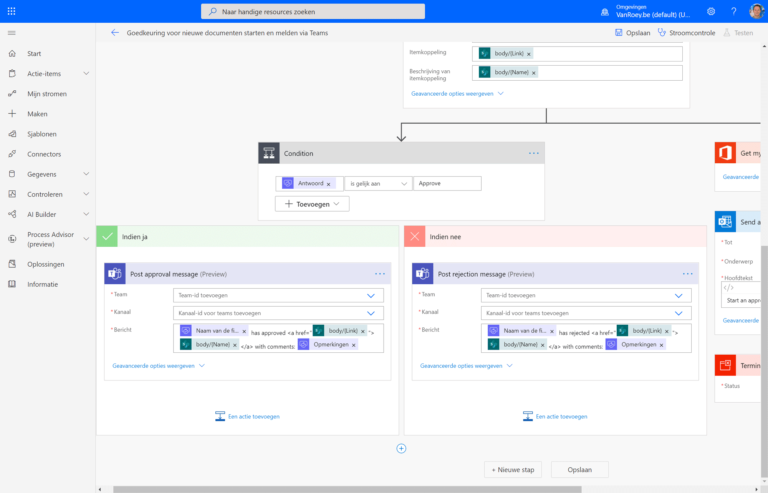

- Implementation of Peppol and Continia Document Capture: We link your Business Central environment to the Peppol network and deploy Continia for flawless automation of your invoice flows.

- Tailor-made advice: Our specialists analyse your processes and integrate Continia solutions so you can process invoices faster and ensure compliance.

- Full support: From implementation to aftercare, we are ready to solve technical and strategic challenges.

With our expertise, you will not only make the switch to e-invoicing, but also improve the overall efficiency of your business processes.

The Continia Delivery Network, moreover, ensures that your e-invoices safe and secure be sent to your customers and suppliers. The network supports various formats and protocols, so you don't have to worry about technical compatibility.

Conclusion: don't wait until the last minute

2026 may still seem far away, but time is flying. By taking action now, you can avoid last-minute stress and get the benefits of e-invoicing right away. Whether you already use Business Central or want to switch: VanRoey provides a hassle-free implementation.

Contact us today and find out how we can get your organisation ready for the future. E-invoicing is more than an obligation; it is an opportunity to modernise your business.

VAT no.

share this post: